Furlough Scheme Introduction – March 2020

The Coronavirus Job Retention Scheme, or Furlough as is now synonymous, was first announced on 20 March 2020 and has been integral in supporting UK employers in paying their employees during the Coronavirus (COVID-19) pandemic.

The Scheme was rolled out at unprecedented speed and has undoubtedly saved thousands, if not millions, of jobs across the UK. Employers could claim from the government 80% of a furloughed employee’s salary for hours not worked, up to a cap of £2,500 per month.

Furlough, whilst essential, has cost an astounding £66bn.

UK & NI Statistics

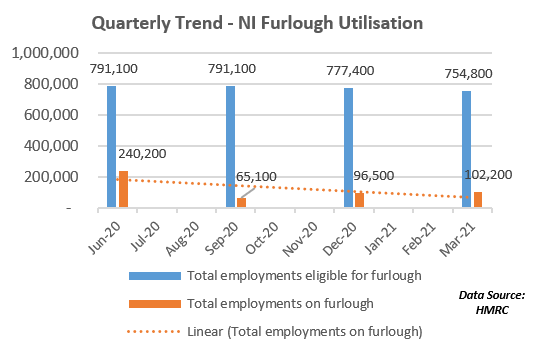

From a UK wide perspective, numbers on Furlough peaked at 5.1m in January 2021 and have fallen gradually to 4.3m as at 31 March 2021.

Taking Northern Ireland in isolation, the uptake (and reliance) remains high as we ease out of lockdown, highlighted by the c. 100,000 people still on furlough as at 31 March 2021.

Changes to the Scheme – July 2021

The scheme is due to end in the Autumn, however, as the economy continues to open up, the government hopes that most furloughed workers will be able to return to work and therefore employers will be required to start contributing to the cost of keeping staff furloughed.

How is Furlough changing?

- From 1 July, the government will pay 70% of a worker’s salary (i.e. up to £2,187.50), and employers will pay 10% (up to £312.50), leaving employees with 80% of their previous salaries, up to the same £2,500 monthly limit.

- In August and September, the government will pay 60% (i.e. up to £1,875) and employers 20% (up to £625), up to the same £2,500 limit.

Sector Reliance

The 5 industry groups with the highest uptake rates, driven largely by trading restrictions and “lockdowns”, are beverage serving activities (70%), hotels and accommodation (65%), passenger air transport (55%), photographic activities (51%), and travel agency and tour operator activities (49%).

Time to Act

- Analysis from the New Economics Foundation suggests once furlough ends a further 850,000 jobs could be at risk with respect to redundancy or reductions in hours or pay. The scheme’s primary purpose was to avoid mass redundancies, but for some employers the support will have only delayed the inevitable.

- From an employer’s perspective it is time to act. Adequate planning is crucial. With various government supports, grants and deferrals starting to taper off, many companies will soon be faced with a requirement for short to medium term cost-saving measures in the face of ongoing economic challenges. Redundancies will form a huge part of this exercise and usual procedures in terms of consultation and notice periods must be adhered to.

- 13-week cash flow forecasting is advisable taking into account any redundancy costs (as well as any other operational restructuring costs) to ensure the business can navigate what will likely be more turbulent months ahead.

Author: Chris McNeill

Email: cmcneill@keenancf.com